solana tx, happens in slots which compose blocks.

1 slot is of ~400ms

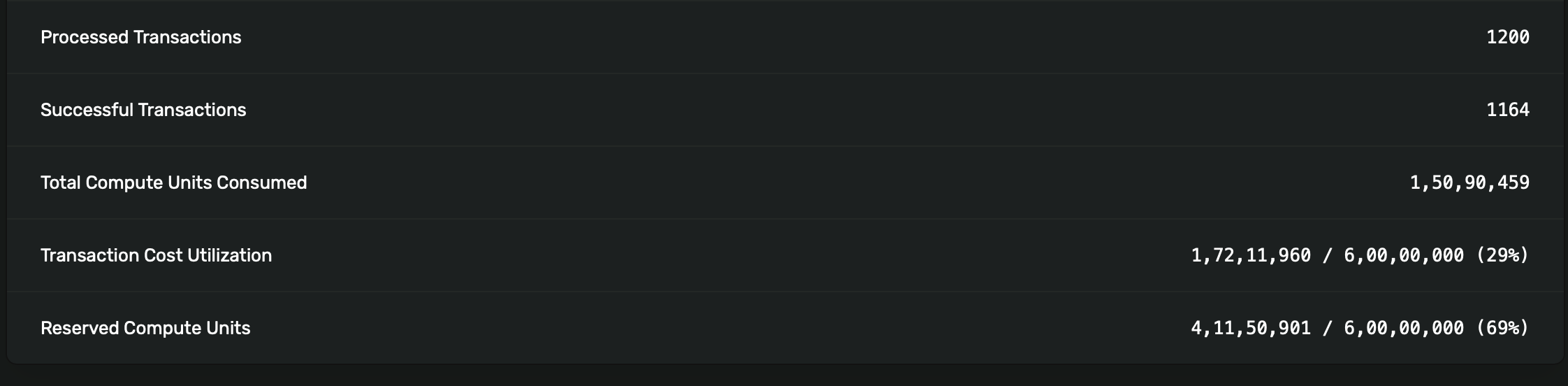

slots have limit of 60M CU, and most of the times slots are underutlised. currently as of 3rd oct 2025, slots are getting utlised on avergage 35%

that leaves room for 65% of CU to be filled, leading to an in-efficiency to be filled.

bam comes into picture here

if we take 1 slot and divide it into smaller slices of 50ms each [ 50ms x 8 = 400ms ], and linearly fill those slices depending on txs demand rather than bursting some slots and leaving some slots based on an auction mechanism which happens at start of each 50ms and based on that order the tx in a slot then this in-efficiency could be reduced by a lot.

++ the main validator should just handle tx processing and not worry about order of the txs. so bam also gives a way to cryptographically verify the order of the txs and whether the order is same as auction or not, thus enabling trust factor.

in action

plugins

- custom logic written by application

- application can decide how the tx going through there protocol should flow

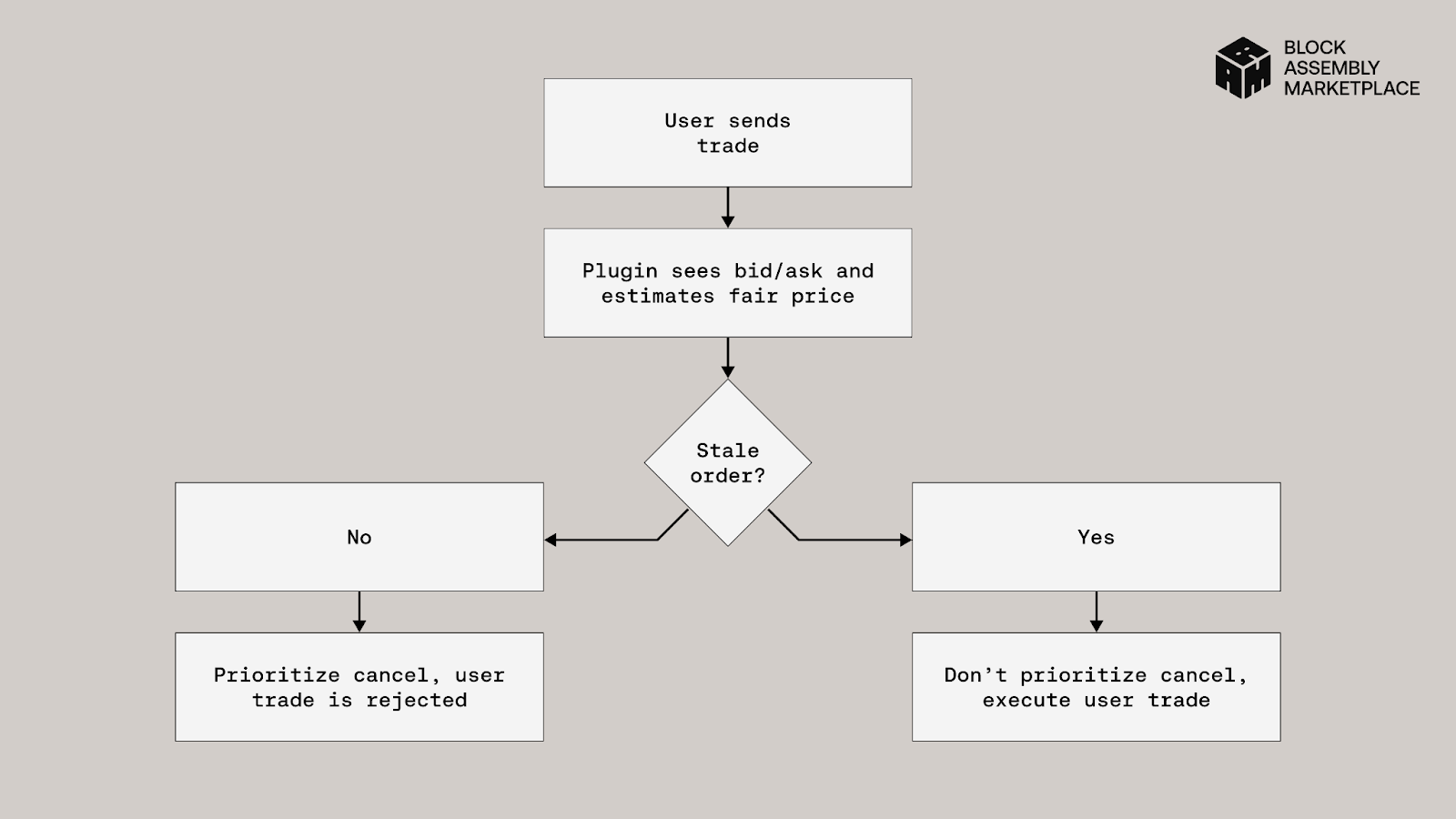

example speedbump

speedbump plugin

a simple plugin which adds whitelisted tx's to a mempool to be executed at pre-decided delayed time, this happens inside a slice [ 50ms ] and delay can be from 10ms to 50ms, in steps of 1ms giving fine-grained control over tx flow

how it ties up?

router

- role of router is to check the tx [ programId, ixs, data, args ] and decide where to send the tx based on programId and plugin.

- only whitelisted ixs are not sent to the plugn, while rest are, allowing to add new ixs to program without modifying the plugin

exmaple scenaior on how all of above ties together:

a MM posts a quote, $SOL sell at 150$, waiting for it to get executed $SOL is trading at 144$ some big news floats around $SOL instantly surges to 155$ before MM could cancle the quote, a buyer sends an order to buy at 150$ with higher fees and get's his tx included first. buyer makes 5$/share profit, MM at loss

before bam

T+0ms: News breaks, price should be $155

T+5ms: MM sends cancel for $150 quote

T+5ms: Aggressive taker sends order to buy at $150

T+10ms: Both arrive at scheduler

T+10ms: taker gets filled, MM loses money

after bam + speedbump

T+0ms: News breaks, price should be $155

T+5ms: MM sends cancel for $150 quote

→ Router: No speedbump (negative marker match)

→ Immediately to scheduler at T+5ms

T+5ms: Aggressive taker sends order to buy at $151

→ Router: Speedbump triggered!

→ Held in speedbump pool until T+25ms

T+5ms: MM's cancel executes, removes $151 quote

T+25ms: Taker's order finally reaches scheduler

T+25ms: Order fails - quote no longer exists

MM protected!

ibrl + ace ftw

sources

- https://bam.dev/blog/understanding-bam/

- https://forum.bam.dev/t/brainstorming-paths-to-ace-on-bam/28

- https://www.anza.xyz/blog/the-internet-capital-markets-roadmap